Given London’s popularity as a financial center worldwide, the British government is working on a set of reforms that will make the country’s financial regulation more agile and responsive to new developments, thereby improving the competitiveness of the UK financial services industry.

It has been three years since the UK officially left the European Union. The recent collapse of Silicon Valley Bank (SVB) on 10 March 2023 has raised concerns about banking regulation and the future funding of the technology industry in the UK. It is time to assess where UK financial regulation and services are headed.

UK Financial Regulatory Architecture Overview

To ensure the financial services regulatory framework is future-proof and suitable for the UK’s new position outside the EU, the Future Regulatory Framework (FRF) Review was established. Using the authority granted by the Financial Services and Markets (FSM) Bill, it details the government’s strategy for delivering a comprehensive FSMA model of regulation.

The Financial Services and Markets Act 2000 (FSMA) established a domestic regulatory model in the UK, which was subsequently modified to address regulatory failures that contributed to the global financial crisis of 2007- 2008. The Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) are two operationally independent and expert financial services regulators that, within a framework established by the government and Parliament, generally set the direct regulatory requirements that apply to firms in their rulebooks.

Regulatory Authorities

The Financial Conduct Authority (FCA)

The FCA oversees the United Kingdom’s financial services sector. It serves three primary goals, namely:

- Market safety for the consumer

- Boosting Trust in the Market

- Fostering Competitive Equity

Prudential Regulation Authority (PRA)

The PRA is an organisation under the Bank of England’s jurisdiction that oversees the financial services industry in the country. Additionally, the FCA and this group collaborate closely to make the UK business regulatory environment as welcoming as possible.

Among the PRA’s primary goals are:

- Promoting safety and assuring the financial stability of the businesses it regulates.

- Ensuring the correct level of protection for policyholders – mainly applies to insurers.

HM Treasury

Her Majesty’s Treasury (Treasury) has an impact on bank regulation as well. While the Bank of England (BoE)is responsible for financial stability and monetary policy, the Treasury is the government department in charge of economic and financial policy.

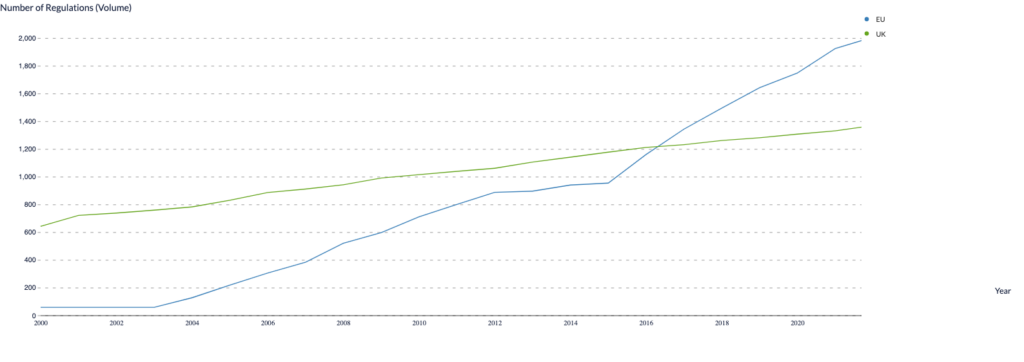

The FSMA framework relies heavily on this principle. EU financial services regulation has grown in recent years following the introduction of FSMA. EU financial services regulation expanded into new areas in the years that followed the FSMA’s enactment. This hampered regulators’ ability to determine the most appropriate regulatory requirements for UK markets. It required them to comply with EU regulations and operate within the EU framework, which impacted the operation of the FSMA model.

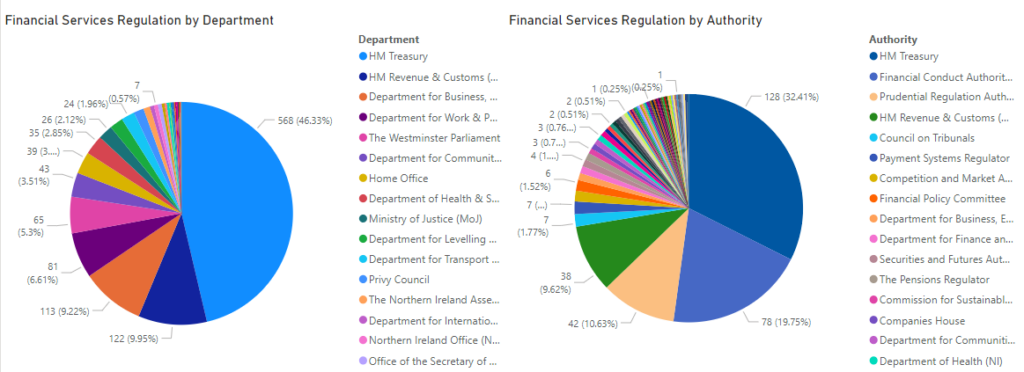

Over the past 20 years, the EU is making more regulations on financial services than the UK, as shown in the chart.

In the UK, HM Treasury made almost half of the regulations for financial services (pie chart at the left). Regarding the authority that governs the financial sector, the top 3 are HM Treasury, Financial Conduct Authority and Prudential Regulation Authority.

Financial Services and Markets Bill 2022-2023

Just 18 months after the end of the transition period marking the UK’s complete departure from the EU, on 20 July 2022, HM Treasury published the Financial Services and Markets Bill 2022-2023 (the Bill). The Bill establishes the UK government’s regulatory framework post-Brexit and proposes several significant amendments to existing UK regulations.

What does the Bill propose?

- The Bill allows HM Treasury and the UK’s financial services regulators to revoke retained EU law. These regulators include the PRA, the FCA, and the Bank of England (Bank and together with the PRA and FCA, the UK Regulators).

- The Bill strengthens the regulatory framework for financial services as set out in the Financial Services and Markets Act 2000.

- The Bill improves the framework of objectives and principles that guide the actions of UK regulators.

- The Bill requires UK regulators to respond annually to HM Treasury recommendations under the FSMA. The Bill also creates a formal requirement for UK regulators to keep their rules under review.

- This Bill grants the relevant UK Regulators (in this case, the Bank or the FCA) new powers to implement, supervise, and enforce the senior managers and certification regime (SM&CR) by extending it to central counterparties (CCPs) and central securities depositories (CSDs).

- In accordance with the Financial Stability Board’s 2017 recommendations for the recovery and resolution of CCPs, the Bill establishes a unique resolution regime for CCPs if all or a portion of their business encounters financial difficulties.

- The Bill strengthens the protections for insurers and policyholders during the insolvency and write-down processes. It permits the insurer, shareholders, policyholders, or other creditors to seek a write-down order from the court.

- The Bill protects people’s and businesses’ access to cash by making sure that people can still withdraw and deposit cash all over the UK.

- The Bill contains a variety of provisions, including disciplinary action against previously authorised individuals.

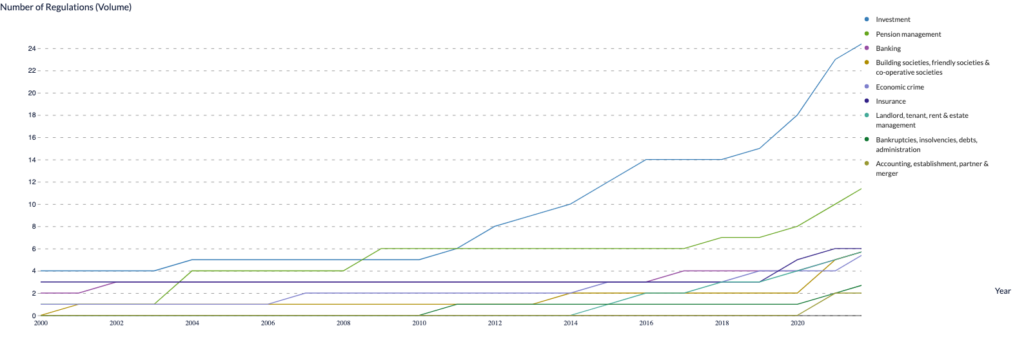

Financial Penalty

There are more and more regulations that impose imprisonment as a penalty for non-compliance with the regulations, specifically when it is related to investment. The chart below shows the number of regulations that have imprisonment as a penalty in the past 20 years, split by topic (e.g. investment, pension management, banking).

UK Financial Services Regulation with imprisonment penalty in the past 20 years, by topic (Data Source: Law Notion – Reglytica, 2023 April)

Financial sanctions include restrictions on designated individuals, such as freezing their financial assets, as well as broader restrictions on investment and financial services. The Policing and Crime Act 2017 empowers HM Treasury to impose monetary penalties for violations of financial sanctions. The Treasury’s Office of Financial Sanctions Implementation (OFSI) oversees enforcing these sanctions. Here it explains what the powers are, how OFSI will use them, and what a person’s rights are if OFSI imposes a monetary penalty on them.

Final Thought

To successfully navigate the intricate regulatory landscape of the UK’s financial sector, a thorough understanding of its architecture is essential. With Brexit, the UK has a unique opportunity to implement a “better regulation” approach that maintains high standards while streamlining regulatory requirements.

At Law Notion, we understand that this can be a challenge. Through Law Notion – Reglytica, we can help policymaker to eliminate unnecessary bureaucracy, improve legal and regulatory predictability, and encourage innovation to thrive. With our guidance, policymakers can effectively regulate the financial services sector, ensuring its stability and long-term policy-making success.